Macro Minute: Week of December 18, 2023

Today I have to talk about the Federal Reserve meeting last week. In not so many words, Jerome Powell signaled that they are done and are looking to cut rates three times next year. It is important to look at how markets have been acting the last month leading into this meeting and how they have acted after the meeting to gauge how important this meeting is being interpreted.

Let’s start with interest rates. The main pricing mechanism for determining most interest rates in the financial world is the 10-year treasury. On October 18th the 10-year hit 5%. Going into the Federal Reserve meeting, it had dropped to 4.2%. After Jerome Powell’s press conference, it has fallen under 4%. That is a 20% reduction in the main financing rate of the world. This is a massive reduction in how tight financial conditions are. It will take time for this to filter into things like mortgage rates and loan rates, but it will. As that does, the economic activity should pick up in the coming months and quarters.

Now let’s look at the equity market. The first chart I want to show is the S&P 500. You can see that it exploded higher the same time that rates started rolling over. After the Federal Reserve meeting it continued.

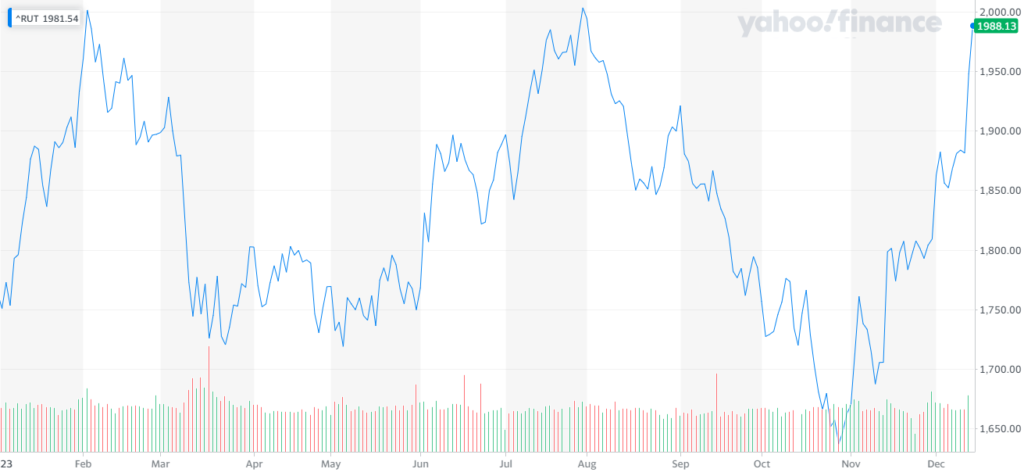

Lastly, let’s look at small cap companies that have lagged all year. As you can see, small caps were at the lows of the year heading into November. Again, we see that as rates turned small caps gained. The big move though has been from the Federal Reserve meeting. With Jerome Powell agreeing with the rates move, it gives small caps more confidence that this rate move will stick and these companies should play catch up to the large caps.

So, let’s try and wrap this up a bit. With inflation coming down, rates have moved lower. With employment and the economy staying resilient, the Federal Reserve has a license to be patient. Now the Federal Reserve feels it has some clarity on the direction of inflation, they feel that they have the go ahead in signaling rate cuts next year. It’s important to remember that markets are forward looking and will price in all of this in advance, hence the moves we have seen over the last couple of months.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.