Macro Minute: Week of December 4, 2023

Today, I want to explore something I have been thinking about for a long time. A few weeks ago, I stumbled across this reposting by Meb Faber:

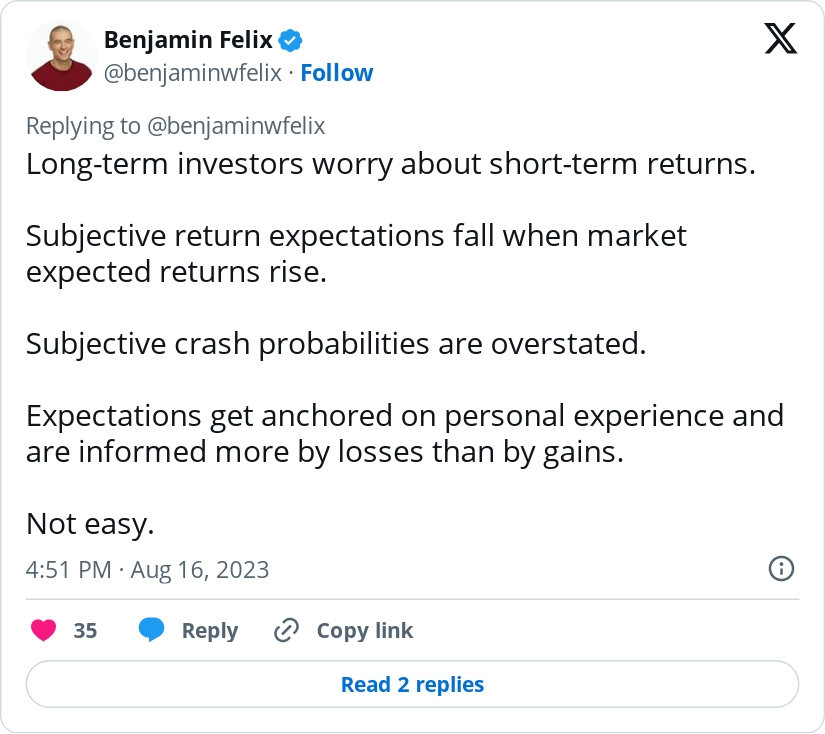

And here are the original posts and a related one Benjamin had written earlier:

I largely agree that the ability to invest has been solved. It has never been easier in human history to cheaply access markets. You can choose between dozens of custodians to setup and open an investment account. Most of them allow you to do it within an app on your phone and have it opened same day. Most of them allow you to trade for free. On top of that, the options you have to invest in has never been better or cheaper. You can buy the S&P 500 and Barclays Agg in a couple of ETFs for an expense ratio of 0.03% a year (that is virtually free). The ability to invest has been solved with this ease of access to cheap exposures. Human nature is still our worst enemy. Even though access has been solved, we still have behavioral tendencies that deter us from optimal outcomes.

Not only do we have behavioral issues that we must confront, but we also have financial planning issues that are abundant and complicated. We have employee compensation plans that make knowing the right thing to do hard to know. We have estate concerns. We have questions that arise around Medicare, insurance, and taxes. Even as we may have solved the ability to invest, our world has completely complicated our financial lives with other things. This is why I believe that the actual investing has been “solved”, but our personal financial situations have never been more complicated.

A couple of closing thoughts on this topic. Meb has had a podcast for years and he recently covered this topic with Corey Hoffstein. They start talking about the topic at the 45:15 mark. Even though investing may have been solved, it is not easy. This is one of the reasons I love working at Longview. We help people make sense of the complicated and are there to help keep a “Longview” perspective on our clients’ investments.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.