Macro Minute: Week of November 11, 2024

Today I want to talk about portfolio construction and why I choose to invest the way I do. To begin with, I look for investments that are different in the way they deliver returns. One could invest in just one asset and live with that return. Sometimes this works out wonderfully and you hear those success stories, like early investors of Nvidia or Bitcoin. The problem with even these very successful investments are the drawdowns. In the life of those investments, you have periods where they lose lots of their value. Nvidia in the year 2022 lost half of its value. To combat these drawdowns, you can invest in baskets of securities. Popularly, many people will invest in the S&P 500 index, which is the 500 largest U.S. companies. But in 2022, the S&P 500 experienced an 18% decline for the year.

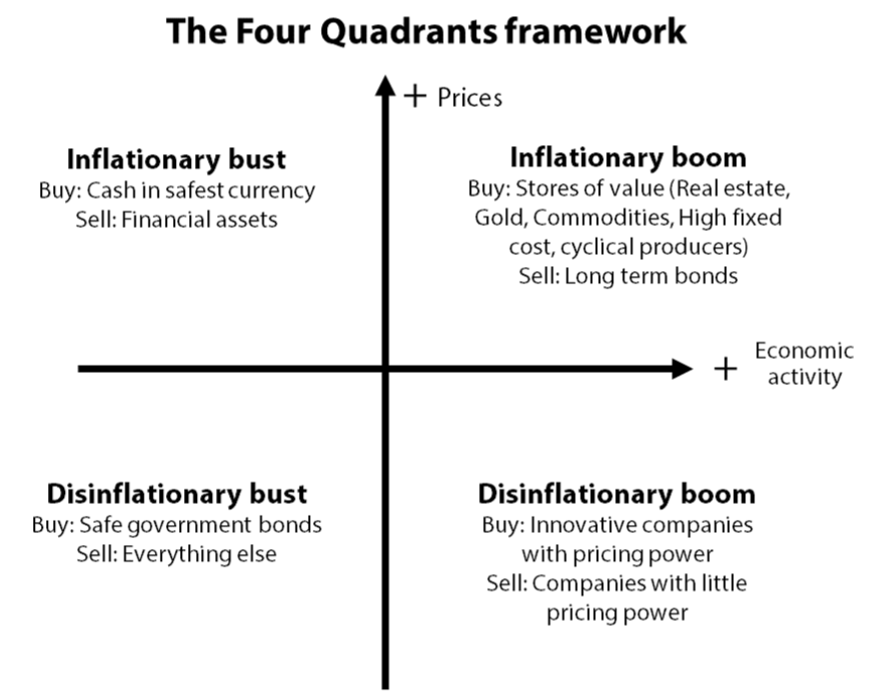

So how do you develop a portfolio that aims to provide good returns while protecting against the large drops in value? I like using a 4-asset class portfolio that has different drivers to generate returns over time. They are global equities, fixed income, real assets, and managed futures. I will break down each one and describe what influences them and how they work together. To me, the 2 biggest factors that influence asset prices are changes in economic growth and changes in inflation. If the economy goes from a period of high growth to low growth at the same time that inflation falls, you can expect fixed income to do well. There is a handy visual to illustrate this relationship. It covers 3 of the assets I include in portfolios, all but managed futures.

When looking at this framework, we can apply some time periods that exemplify each quadrant. The top left inflationary bust can be thought of as 2022. This is a time period when inflation was high and economic activity was falling. It is important to note that this does not mean that economic activity was negative, only that its direction was downward. During this time, equities, fixed income, and real assets suffered, but managed futures were up.

The top right inflationary boom can be described by 2021. Coming out of covid, economic activity boomed along with inflation. Equities, real assets, and managed futures all did well while fixed income suffered.

The bottom right disinflationary boom can be thought of as a year like 2015. That year, growth was positive while inflation fell slightly. Equities were slightly positive, led by the innovative companies in the market. Fixed income was barely up and real assets were down. Managed futures were moderately positive on the year.

The bottom left disinflationary bust is best exemplified by 2008. That year, economic growth ground to a halt and inflation began turning sharply lower late that year. Equities fell precipitously along with real assets. Fixed income did okay during that time, and managed futures did excellently.

Through time, growth and inflation shift around the different quadrants. I like to build a portfolio that has assets that provide exposure to these different factors. Did you notice that managed futures have the ability to provide positive returns in each of the quadrants? This is because it is a strategy that does not rely on a specific environment, but upon emerging trends that it can trade upon. For example, in 2022 fixed income yields rose consistently throughout the year. This allowed managed futures to invest in a way to profit from that trend.

The last point I will make on this post will be a concept from AQR Capital Management. They conclude that over time you need to stay invested to a portfolio and that to deviate from it is a sin. However, from time to time the macro environment is right for a particular strategy to either suffer or prosper. In those times, it can be appropriate to sin a little. Meaning, stay invested to your portfolio, but when a situation comes that you think provides you an opportunity to either avoid some pain or prosper, it is appropriate to shift slightly. In our above periods, a year like 2022 provided the opportunity to sin a little away from stocks and bonds into managed futures.

To summarize, I invest in a diversified portfolio among 4 asset classes while staying macro aware to be able to sin a little when it is appropriate.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.