Macro Minute: Week of October 14, 2024

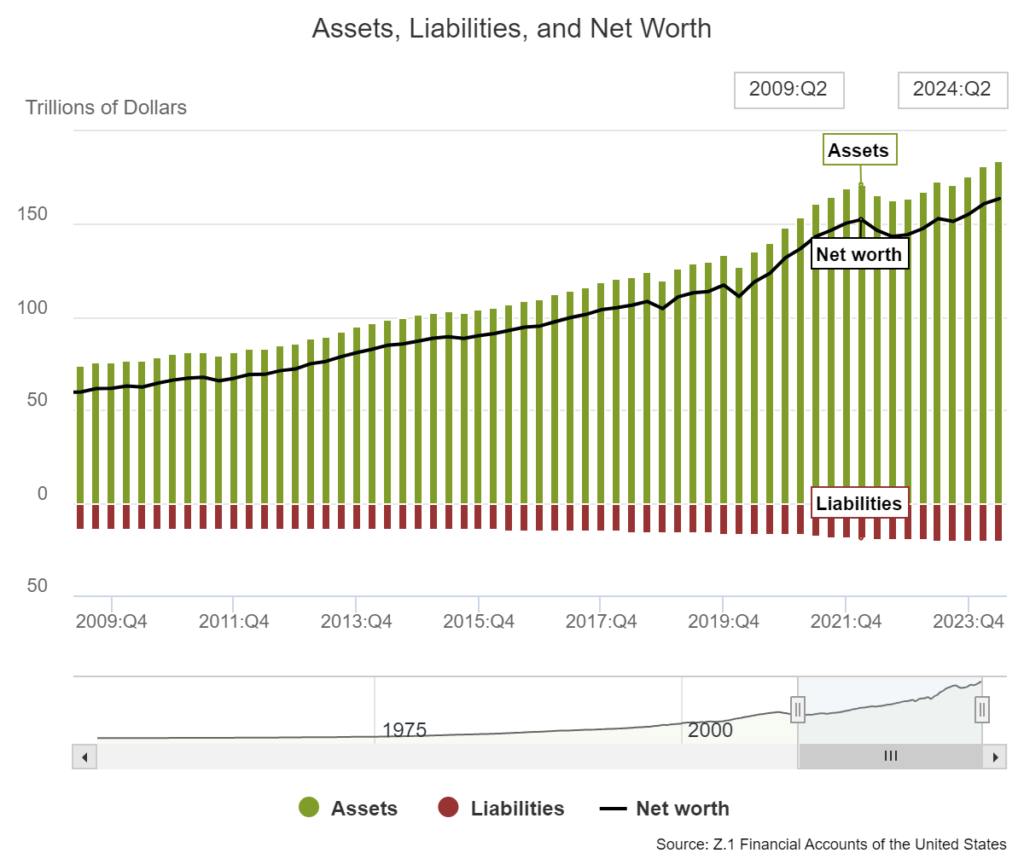

This week I want to highlight a couple of cool charts I have seen lately and make some observations. This week I will keep it brief. First up is a chart from the Federal Reserve showing household wealth levels.

This chart corroborates the view that I have been talking about for weeks, the average household is doing well. I have had the view that households are and will continue to be a center of strength. Implicit in this graph are home values at highs, financial assets at highs, and debt levels are low. With this set up we can expect the U.S. Consumer to be a continued center of strength and should continue to surprise to the upside. There is a lot to like in this chart.

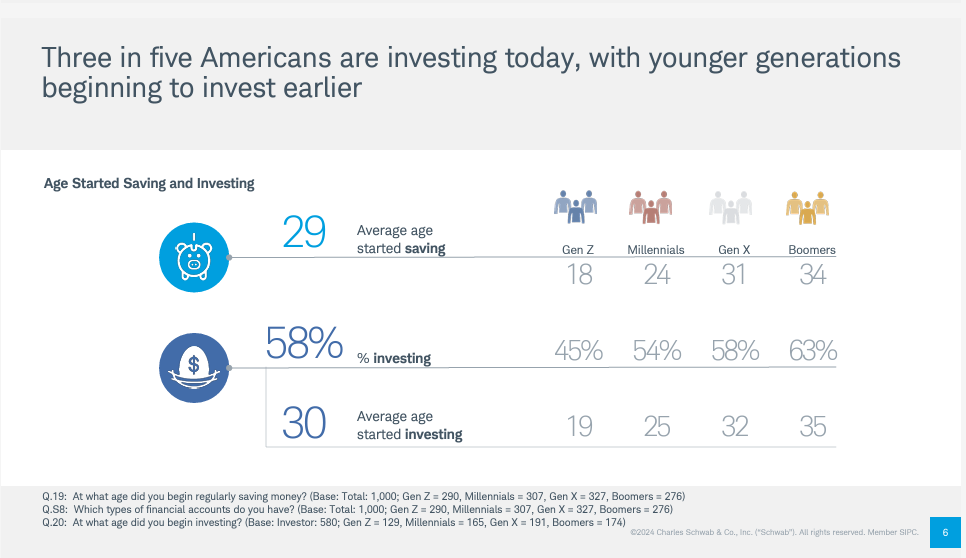

Next, we are going to look at a cool demographics and generations graphic from a Charles Schwab survey.

As a logical thinker, this makes me so happy. With each generation that comes, more Americans are making the smart decision to begin investing earlier. We know that compounding is the name of the game to generate returns. We also know that the only way to get more time to compound is to start early.

Putting these two charts together, we can intuit a lot. We can assume looking into the future there will be a lot of wealthy households. We can also assume that each generation should be wealthier than the one before. This is not even including the wealth that will be transferred from one generation to the next. The impact of this wealth creation will have long-lasting and broad effects in the future. These charts highlight a few reasons that I remain optimistic about the future, and that the best is yet to come.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.