Macro Minute: Week of September 30, 2024

I have written a lot about the market and economy the last few weeks. I will make one simple observation. We can talk about market pricing and interest rates and unemployment, but in the end, it is all about if we fall into a recession. If we fall into a recession then asset prices could fall a lot. If we don’t have a recession, then asset prices should rise a lot. I tend to believe that we will not enter a recession. Let me try and persuade you to my view.

We are currently spending about 7% of our annual GDP in budget deficits. This is stimulative to the economy. This is typically the type of spending that we see when we are in a recession and the government is trying to stimulate out of it. It is like we are pre-stimulating the economy before a recession happens. We are in an interest rate cutting cycle. The Federal Reserve has made it clear that they do not fear a resurgence of inflation and are more focused on the employment mandate. Because of that, they cut rates aggressively to start the cutting cycle. We still have election uncertainty to navigate, and that will have consequences around tax rates, but if we look at things like aggregate wages, home prices, and the average citizen’s balance of financial assets, we are at or near all-time highs. This tends to be a catalyst for continued consumer spending because people feel wealthy. There are pockets of weakness in the world, like China, but they just announced the largest stimulus package since the covid pandemic.

I am not here to suggest that we have not and will not continue to have different measures of economic data that are weak. What I am saying is that the authorities are telling you that they are actively removing restraints from economic growth and that they will continue until they feel like they are no longer a deterrent to economic expansion, or an outright stimulant of economic growth. Financial markets are forward-looking, and because of that they will start to price in these stimulative policies. It is important to remember that financial markets tend to perform well in this period of economic malaise, not too hot but not too cold, with supportive policies.

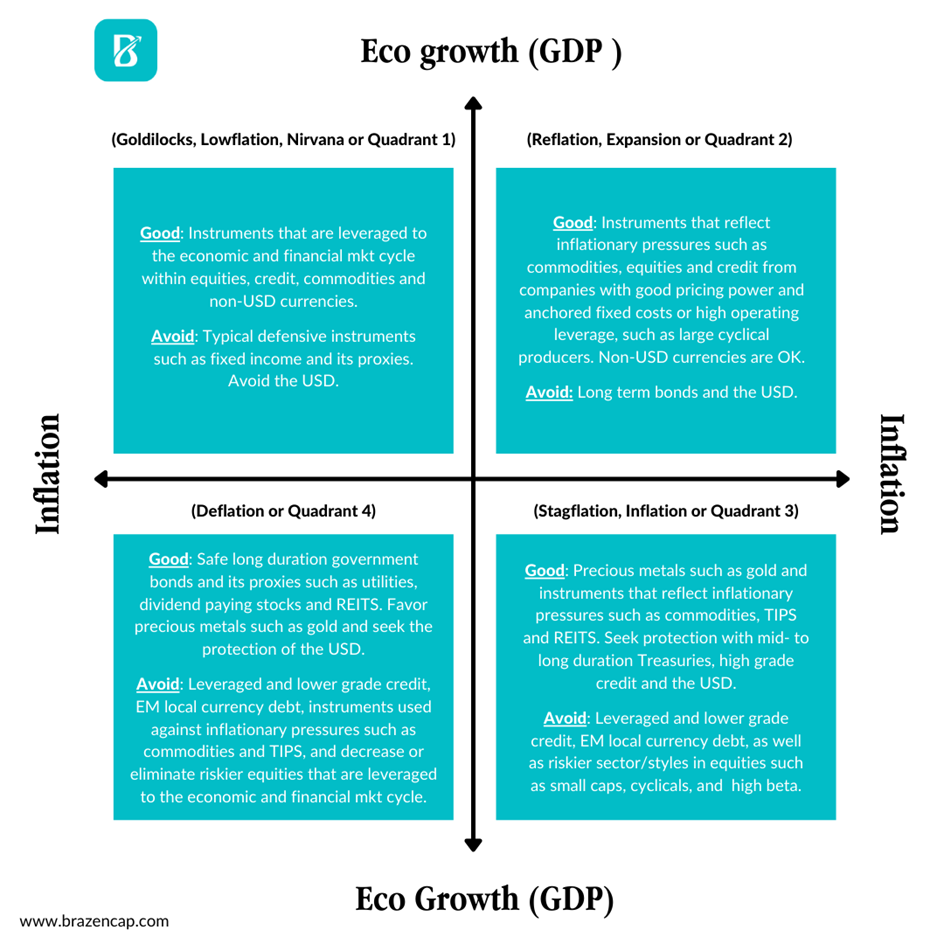

I have posted versions of this chart before but it is a good roadmap guide on how to think about the economy and markets. If I had to visualize how I think the environment we are heading into will be, I think it will be mostly characterized by quadrants 1 and 2 with any dips into 3 or 4 short lived. This leads me to be pretty constructive on risk assets. While no one knows what will happen, I tend to think that the economy has been normalizing and that the authorities are mostly correct to remove restraints to keep that normalization from falling into contraction.

I am hopeful that things will continue to play out favorably without another spike of inflation or material weakness in the economy. We will see how it all turns out, and maybe I have given you a look into why I am optimistic about this outcome.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.