Macro Minute: Week of September 23, 2024

I have been seeing Jurrien Timmer a lot lately and he always has interesting charts. He was on The Compound and Friends last week and gave some perspective that I thought was unique. As background, Jurrien is the director of Global Macro at Fidelity Investments. Let’s dig into his charts and the major takeaways.

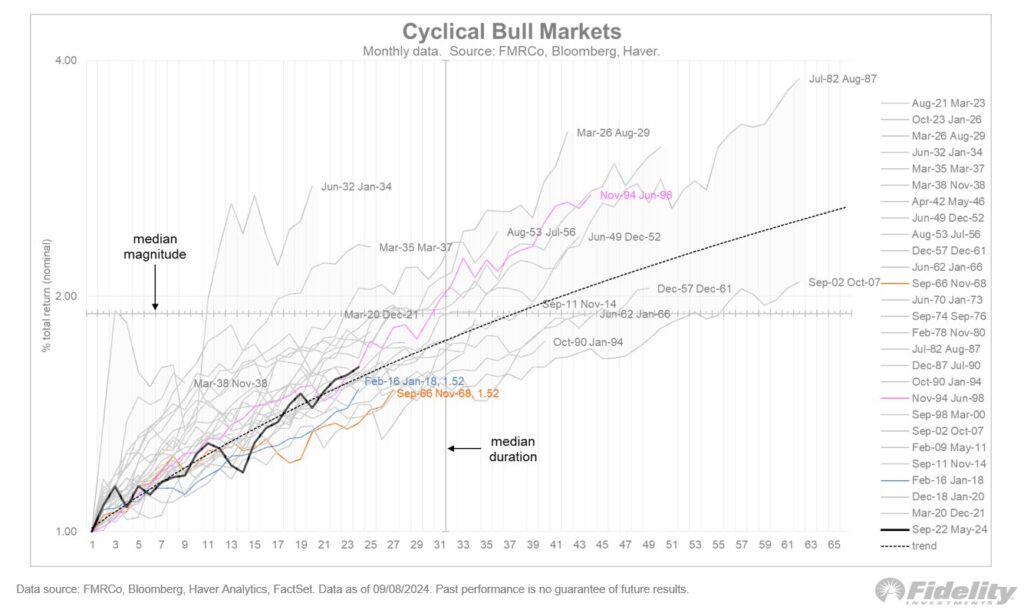

To begin with, let’s look at the current bull market compared to the past bull markets.

The chart is showing that this current bull market has been basically on trend from a returns perspective but is still young in duration. It would be a bit irregular for this expansion to end here.

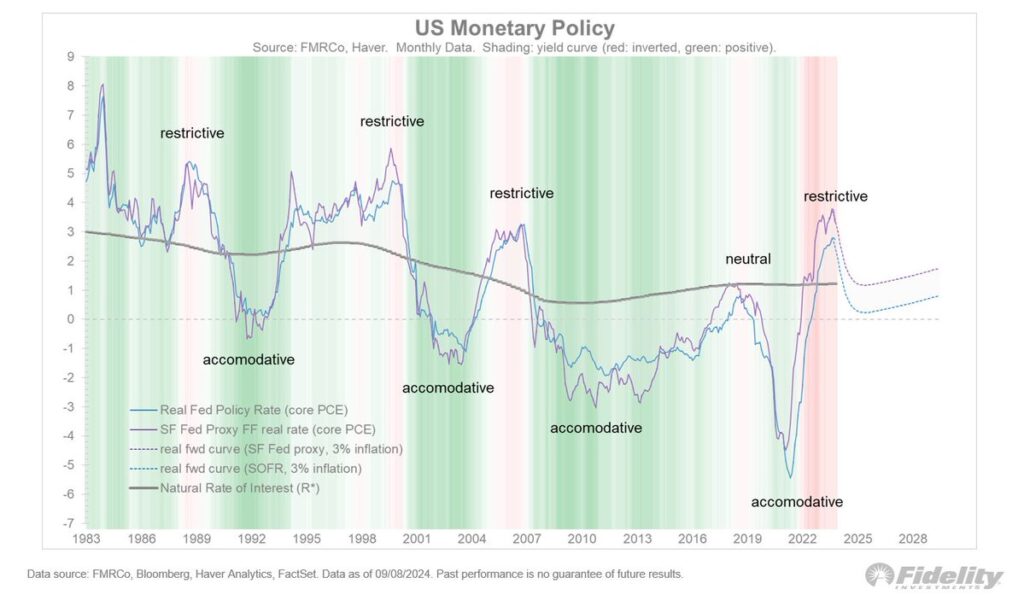

Next let’s look at rates. You have heard me yammering on about accommodative, neutral, and restrictive from a rates perspective for years. Well, Jurrien visualizes this relationship over time and how right now the Federal Reserve has plenty of room to relax rates.

You can see by the red shading that this has been a very restrictive stance for a while and that we are on the cusp of beginning a loosening of policy.

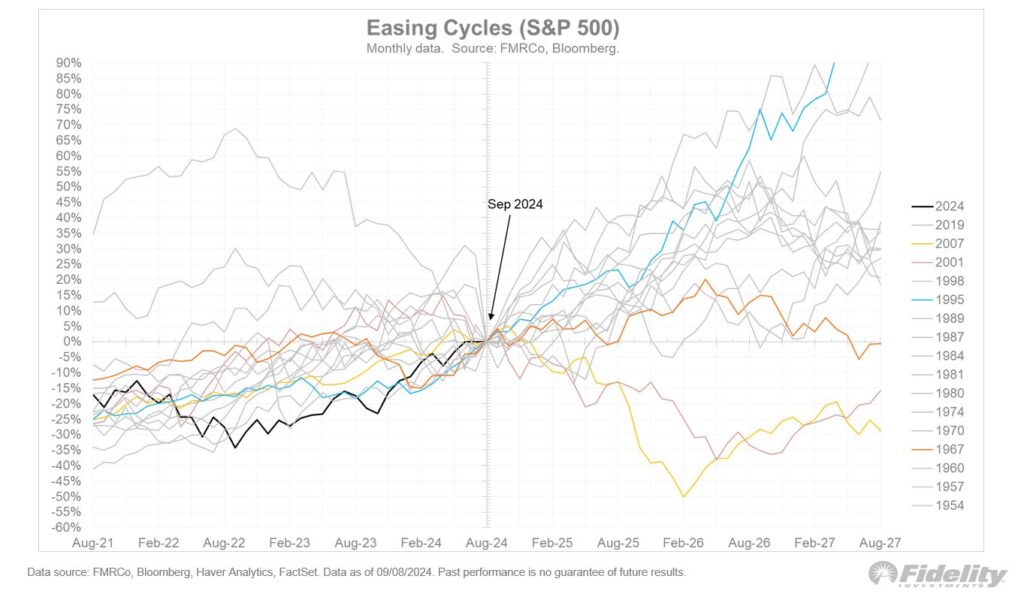

So that brings us to the next chart. What do equity markets do when we begin a rate cutting cycle?

According to history, rate cuts are favorable for equities. The two exceptions to this are 2007 and 2001. Both of those had extenuating circumstances in the housing bust in 2007 and the dot com bust in 2001. In most other cases the market did well with rate cuts.

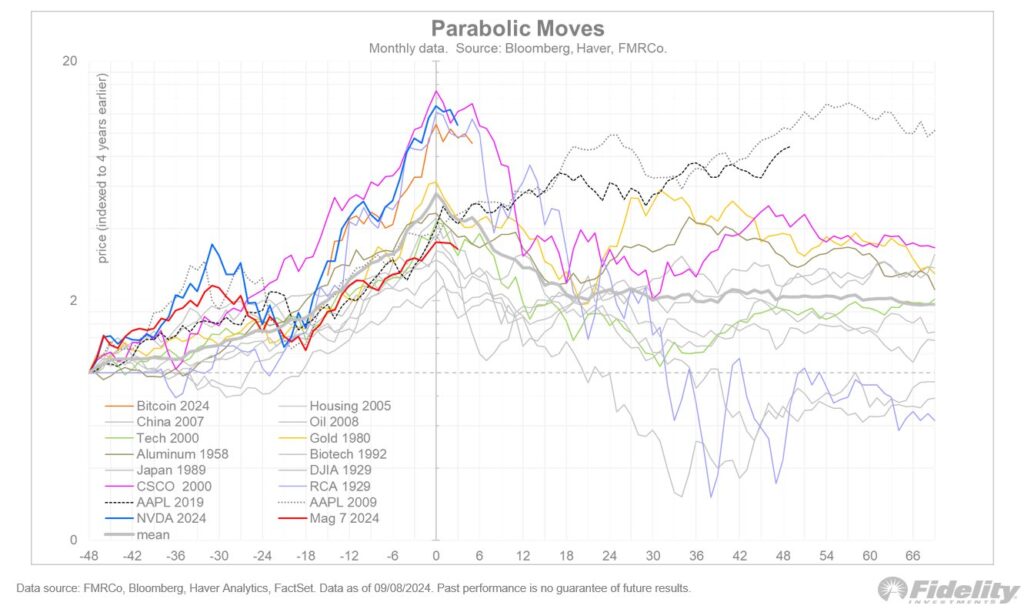

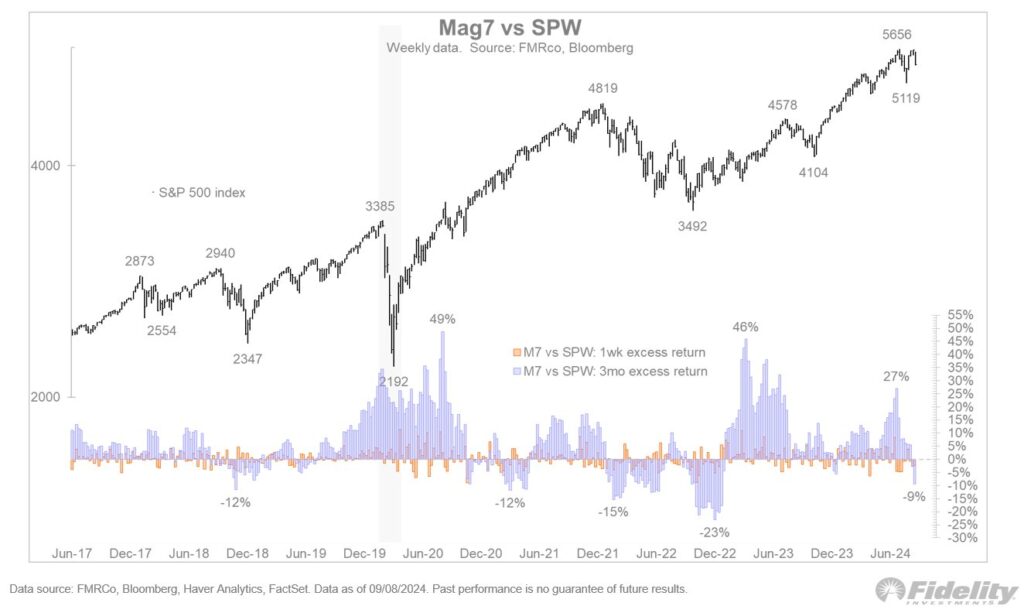

Lastly let’s look at some charts on the Mag7.

This chart compares the Mag7 returns with similar parabolic returns in history. To me this looks mature compared to the others in history, and it may have already begun to roll over. It is also true that it does not mean that it is all downside from here. We could have a stalling out of returns in these stocks with less dynamic returns, for a little while.

This chart is showing that over the last 3 months the broader market has outperformed the Mag7 by 9%. We can see that the expansion is beginning to rotate away from the Mag7 to other companies.

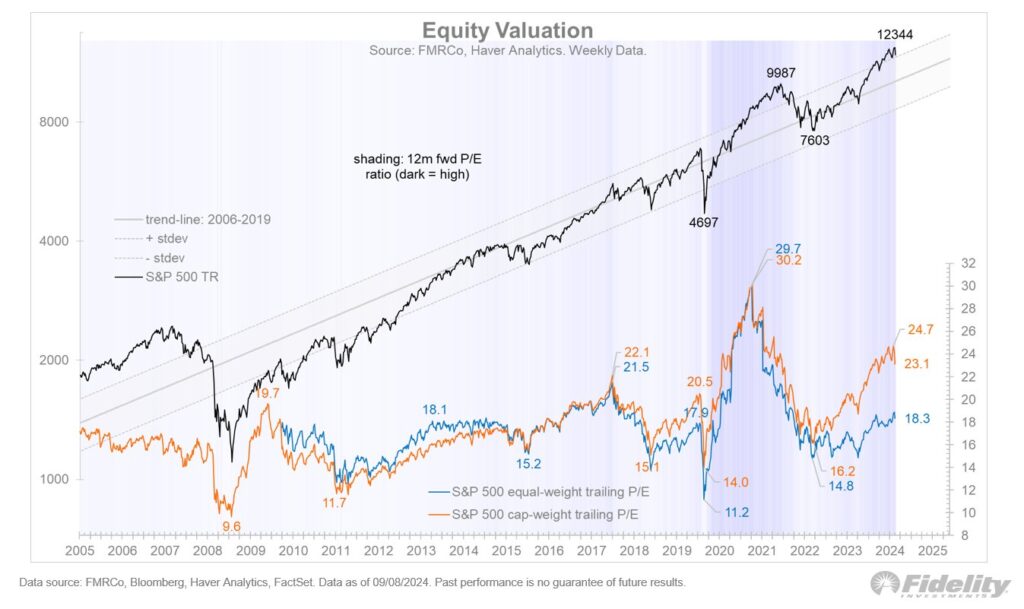

This final chart shows that the average stock is much cheaper than the Mag7, giving further evidence that a rotation could be under way.

To wrap up my thoughts on these charts I’ll say this, the next leg of this bull market may be a handing of the baton from Mag7 to the broader market and the catalyst for this may be the rate cutting cycle. If that happens, it may appear for a time that the market is going sideways even though the average stock is going up. If you are invested in a diversified portfolio, you should have less overall exposure to those seven stocks.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.