Macro Minute: Week of September 18, 2023

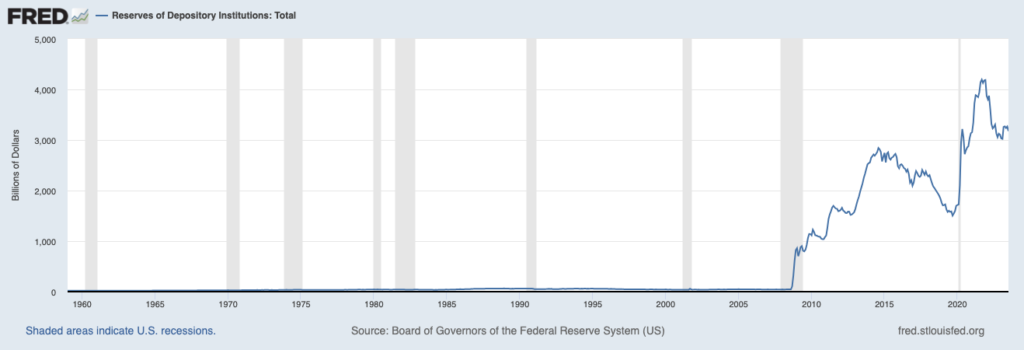

Today I am going to cover a topic I was asked about, the Federal Reserve Overnight Reverse Repo facility (let’s just call it RRP). I am going to be breaking the ‘keep it short’ aspect of the Macro Minute because this is a topic that requires background. Before we can analyze if current developments are positive or negative for markets, we have to identify what is the RRP and what is it used for. To understand the RRP we first must talk about Bank Reserves. Bank reserves are what is created when the Federal Reserve buys treasury bonds from the banking system (known as quantitative easing or QE). These reserves are locked in the banking system and cannot be spent in and of themselves. They can sit on bank balance sheets and used as reserve requirements against loan creation. This system came into great use in 2008 and after.

In an effort to maintain a consistent effective federal funds rate (EFFR), they needed to start paying interest on these reserves in order to keep them within a close range of the EFFR. There is just one problem, you must have access to the federal reserve banking system to take advantage of this interest on bank reserves. There are more and more non-bank entities in the economy that are not a part of that ecosystem. This is where the RRP facility comes into play. In essence, RRP allows a set of non-bank entities, through money market funds, to get equivalent rates of interest as the reserve banking system. These facilities work together to ensure that there is a floor on the fed funds rate.

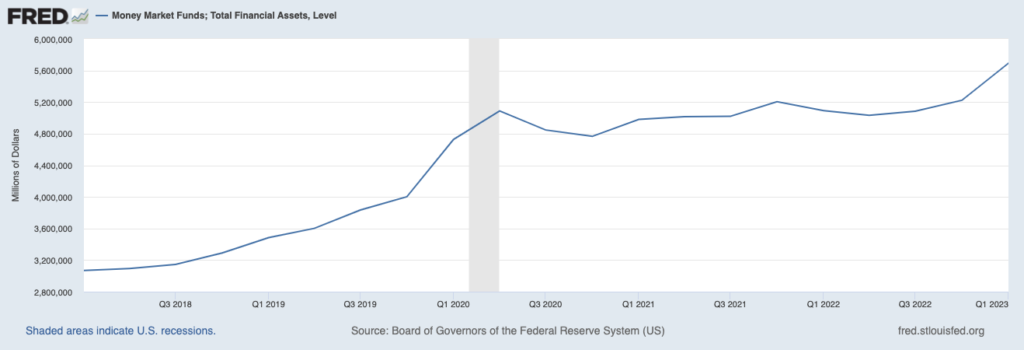

Here we can see that money market funds have continued to rise over time.

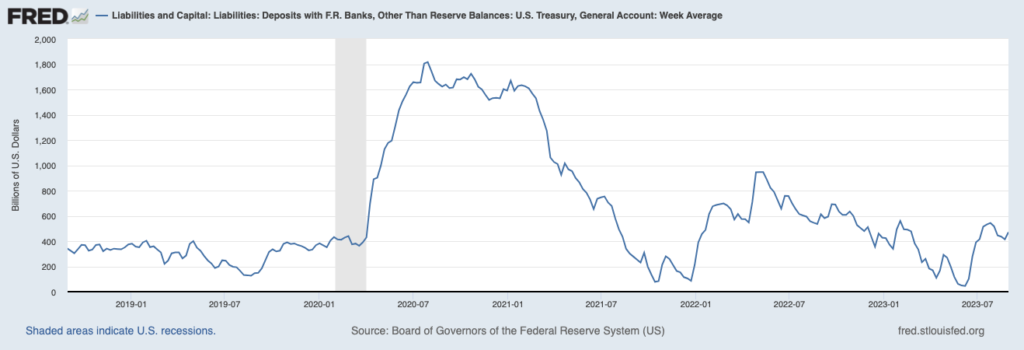

You would think that the use of RRP would rise in conjunction with the rise in money market funds, but we can see that the RRP started going down in 2023. So, what is causing this divergence? To explain, we must bring a new player onto the scene. Let’s talk about the U.S. Treasury, specifically the treasury general account (TGA).

The TGA is kind of like the government’s checking account. It goes up and down depending on how much the Treasury issues debt, receives in tax payments, or pays out government liabilities. Most recently, when the government had to pass a debt agreement the TGA was drown down to very low levels. Getting back to the RRP, you will notice when the TGA was brought back into a more normal balance off of that low level, the RRP started coming down. This is because treasury issuance was a lot of short dated treasuries that money market participants bought instead of using the RRP facility because the interest rate is higher.

Let’s end with how this can change markets. It is important to remember that that the RRP and interest on bank reserves are just tools that the federal reserve use to ensure that the federal reserve rate is held at their desired level. So that is the first way in which these facilities can be used to affect markets, if rates are too restrictive or too loose the market will react. The second thing to watch is the TGA. If it is increasing, it is usually restrictive to markets unless it is being offset by RRP decrease. If TGA is decreasing, it is being spent into the economy without offsetting debt being raised, which usually looks like fiscal stimulus to markets. In my opinion, what we have seen recently has not been meaningfully net positive or negative from the RRP drawing down. What is most concerning to me is the ongoing net issuance from the Treasury and the upward pressure that puts on longer term interest rates.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.