Macro Minute: Week of September 9, 2024

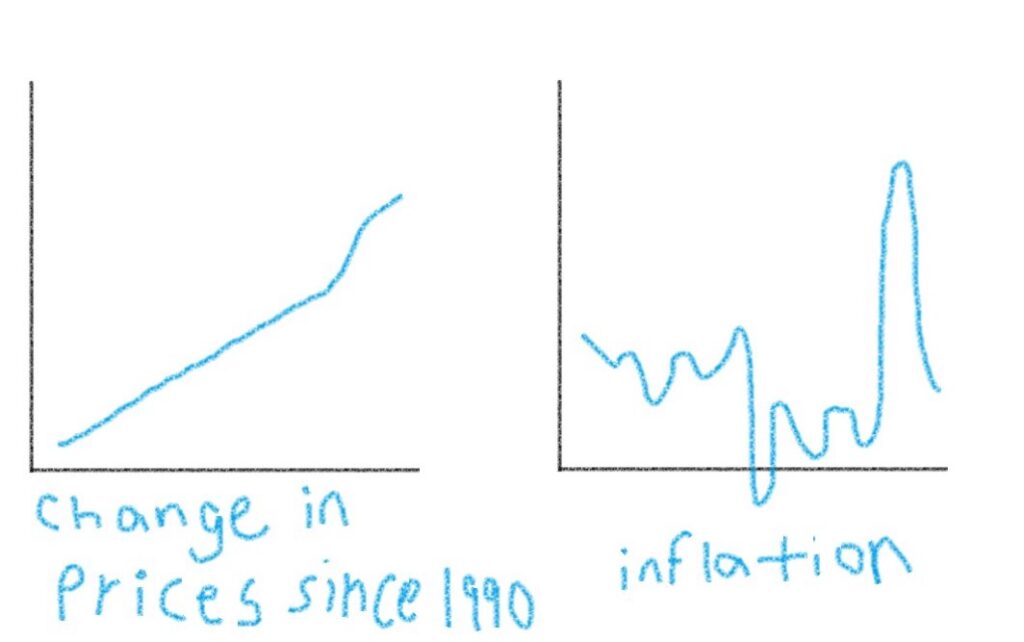

I feel the need to give an update on how I see markets and the economy at the moment. This will be a mix of different analyses and timeframes. To begin, I feel compelled to start with the Federal Reserve because everyone likes to blame them or credit them for everything. In judging monetary policy, it is important to remember that they have two mandates, full employment and stable prices. When analyzing the current positioning of stable prices, we can see that inflation has been falling consistently and that it has not had a lot of variability in recent months. Remember that inflation is the rate of change of prices, not the level of prices. Nick Timiraos had a great illustration when describing this dynamic.

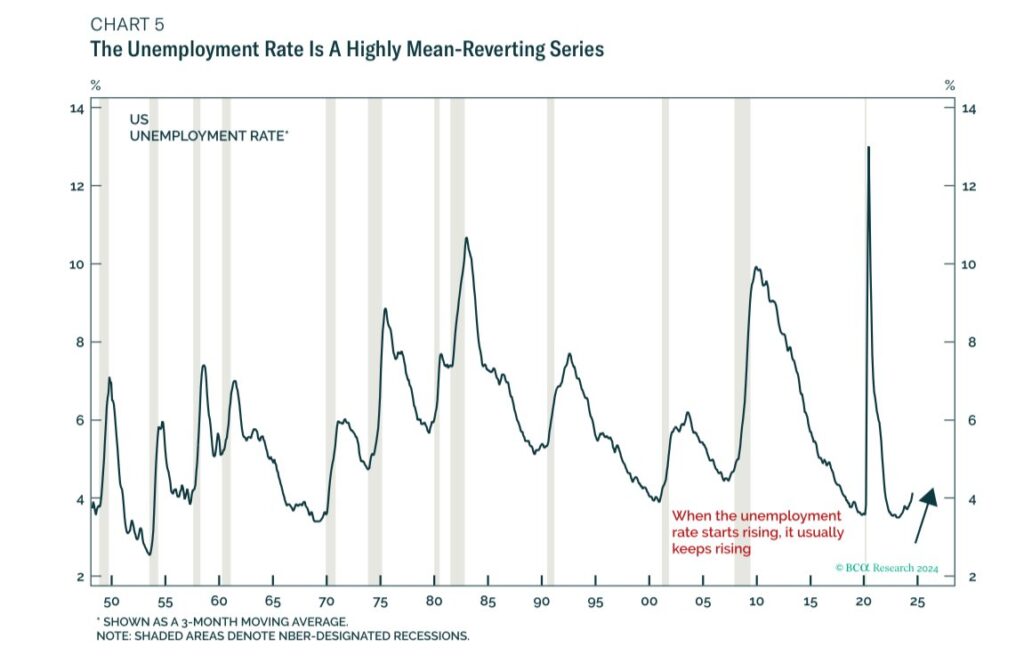

As you can see, just because inflation comes down prices NEVER do. Now on the full employment front, the Federal Reserve is beginning to be concerned. To quote Jerome Powell’s Jackson Hole speech “We do not seek or welcome further cooling in labor market conditions.” What he is referring to is the recent uptick in unemployment. The reason this has them so concerned is because history shows that once it begins to move higher it continues to move higher. BCA’s Peter Berezin put out this chart showing the history of the unemployment rate.

While we have triggered several historically accurate recession indicators with this move higher in unemployment, this rise has been triggered by an increase in labor participation. What this means is that the unemployment rate has increased mainly from more people seeking employment rather than people being fired.

To give the most accurate description of current Federal Reserve policy I will use Jerome Powell’s own words, “The time has come for policy to adjust.” Monetary policy is about to embark on a rate cutting cycle that on bringing the policy rate from restrictive to neutral and eventually easing into stimulative if the economy deteriorates. In practical terms this means that they want to take the current rate of 5.25% to a more neutral rate of 3%-3.5%. They also allow room to drop rates into the 2% range if they deem it necessary.

Next, let’s look at markets. In looking at the overall US market, it is expensive, but not grievously so. The majority of the expensiveness comes from the largest companies. The smaller companies are still inexpensive. International markets are not expensive, especially emerging markets. The dollar has been weakening relative to other currencies finally and that provides benefits to international markets, emerging markets, and commodities. Earnings for the majority of companies this quarter exceeded expectations and future earnings growth is expected to be ok. Corporate balance sheets remain healthy. The main victim of the rate increase policy has been housing. With rates higher, it has meant that existing homes have not been brought to market and the majority of home sales the last few years have been new constructions. With rates coming down, we could see a modest increase in home purchases and refinances. Time will tell, but I do not expect as much of a boom as in the past because sub 3% mortgages are hard to trade out for 5.5%-6.5% mortgages even if you unlock home equity.

The last thing I want to do is put some larger historical context around market corrections and bear markets. A correction is defined by a 10% move down from the market high while a bear market is a 20% move down. Corrections are common, happening about every other year while bear markets are much rarer happening about every five years, but they can go much longer in between. I will say this too, every 5% pullback “feels” like it will be a correction and every 10% correction “feels” like it will be the biggest bear market that has ever been. With this in mind, let’s look at the recent past. We had a bear market in 2020, 2022, and we came very close to a correction this summer, and did have one in the Nasdaq. We have basically had a bear market or correction every other year since 2020. This is an abnormally large amount of downside without having a recession outside of covid lockdowns in 2020. Jim Leitner said that we should “listen to the game master.” To me, the game masters right now are Chairman Powell and both presidential candidates. In the case of Powell, he has made it clear that he has always thought inflation was transitory and that further weakness in the job market will not be tolerated. Both candidates have expressed different ways to expand the economy and deficit spending is churning away in the background. We now have an environment where fiscal and monetary policy are both pushing for economic expansion and are saying that economic weakness is not wanted. Corporate balance sheets are in good shape. The areas of excess that have built up are in private companies; they can hide those mark downs for a long time. The public companies went through a severe rerating cycle in 2022 and are not full of excess like before. All that being said, I cannot tell the future, but I would not be surprised if we go through a fairly robust expansionary time that is good for most markets and economies. I’m not ready to declare this the roaring 20’s like Ed Yardeni, but I do think that things are pretty good all things considered.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.