Macro Minute: Week of August 28, 2023

The other day, I came across this article by Ted Seides in which he discusses the phenomenon of the “magnificent seven” companies (Apple, Microsoft, Alphabet (Google), Meta (Facebook), Amazon, Nvidia, and Tesla) and their significant influence on the US stock market. Seides explores the idea that these companies have become a central consideration for portfolio managers, prompting the question of how much exposure one should have to the Mag7. While historical instances of concentration in a few companies have occurred, what sets this situation apart is that all seven companies share concentrated risk exposures in the same or related industries. This prompted me to delve into an analysis of the extent to which these companies contribute to the US and International equity markets in comparison to our benchmarks and portfolios.

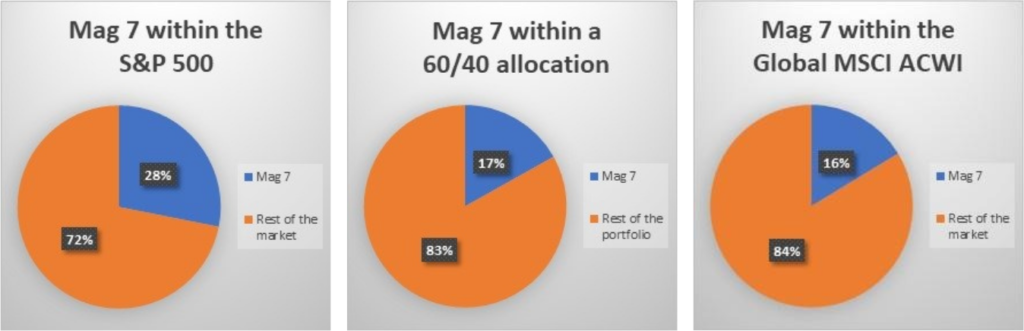

As you can see by the charts above these seven companies make up a dominant portion of not only the US but all equity markets. Even a 60% S&P 500 and 40% bonds portfolio still has a large weighting in these seven stocks. At Longview we take a truly diversified approach to investing. We use benchmarks comprised of global equities, bonds, real assets, and managed futures. Let’s look at how the portfolios we manage compare to these benchmarks.

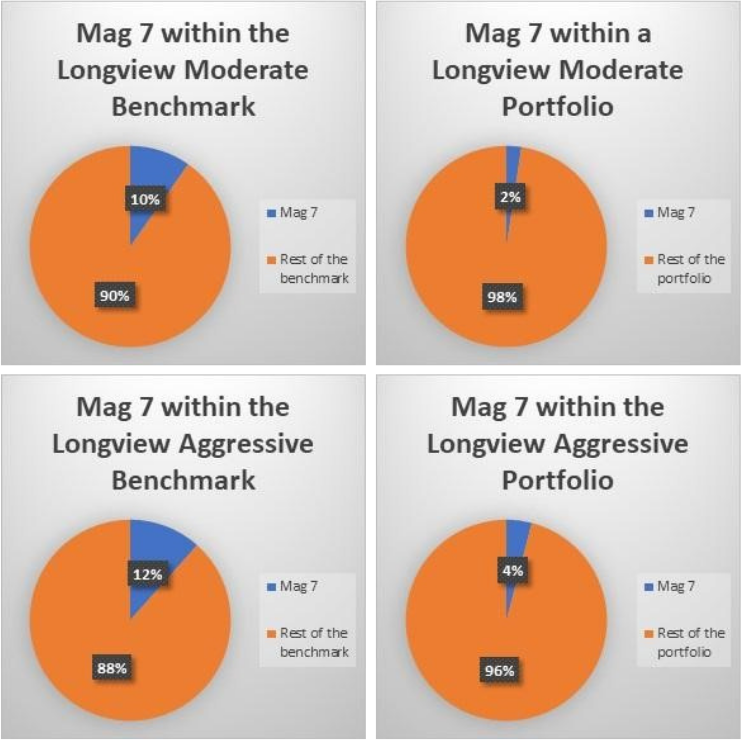

As you can see from above that our benchmarks have less exposure to the Magnificent Seven than most benchmarks, but the portfolios that we manage have dramatically less. We have made our decision on the single question Ted asks, but I am curious if the average investor is even aware of how much of these seven companies that they own? We have intentionally made our choice because we want to be exposed to a wider array of companies and opportunities and the risks that come with them. That’s what we consider true diversification. I will end with this quote from Ted. “The winners will make the right call on their allocation to the mag seven, and that’s about it. The entire investment process and the typical importance of behavioral, analytical, informational, or technical edge will be swamped by that one decision when assessing returns for the foreseeable future.”

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.