Macro Minute: Week of August 21, 2023

I thought I would take a minute and give a lay of the land on current conditions*. This will be chart heavy. Inflation is the dominant factor still because it has been driving Federal Reserve policy decisions.

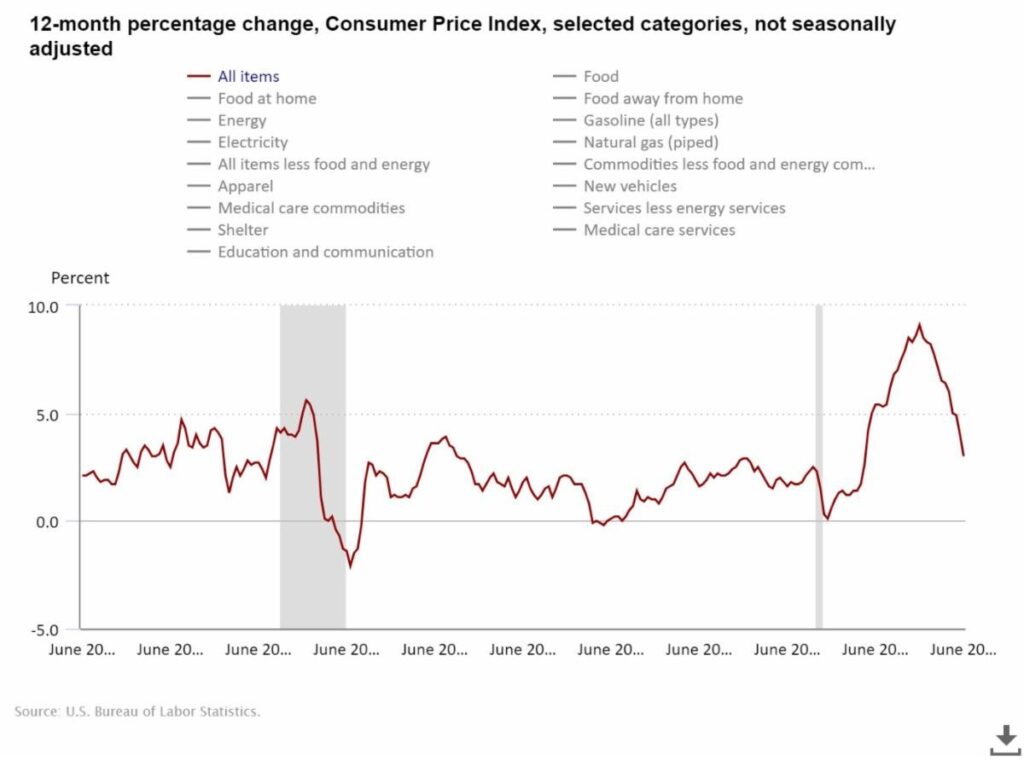

This chart shows CPI for the last 20 years. We can see that we have gone from basically no inflation in 2020 to very high inflation of 9.1% to now a more average inflation 3%. Let’s look at the other mandate the Federal Reserve has, full employment.

Here, we can see that about the time inflation was close to zero, unemployment was very high. Unemployment has continued to go down and has stayed at what historically would be considered very low levels. Basically, the jobs market is continuing to be tight.

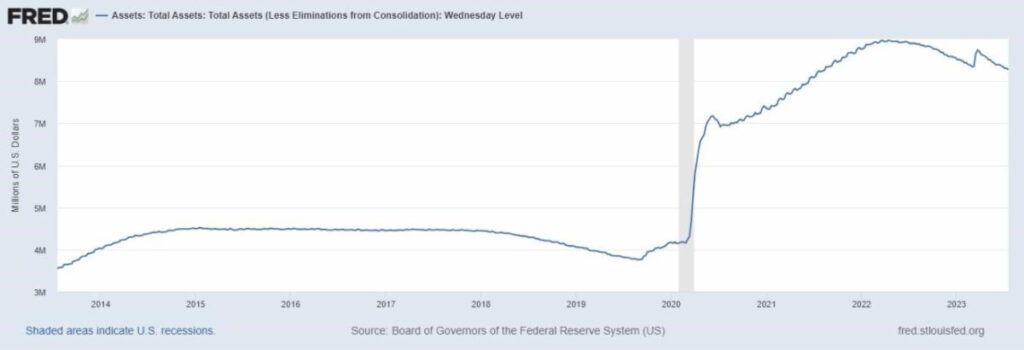

Let’s look at actual Federal Reserve policy tools. The two main tools are interest rates and the balance sheet. In general, lower rates and an increasing Federal Reserve balance sheet are expansionary and higher rates and a decreasing Federal Reserve balance sheet are contractionary. Let’s see where we are with both.

We see that massive stimulative policies were enacted in 2020, lowering rates and expanding the balance sheet. In 2022, the exact opposite policies were enacted with rates rising from zero to currently 5.5% and the balance sheet being allowed to roll off (with the minor exception of the bank support provided in March 2022). This leaves us with a Fed Funds rate 2.5% higher than inflation currently and a balance sheet that is continuing to decrease.

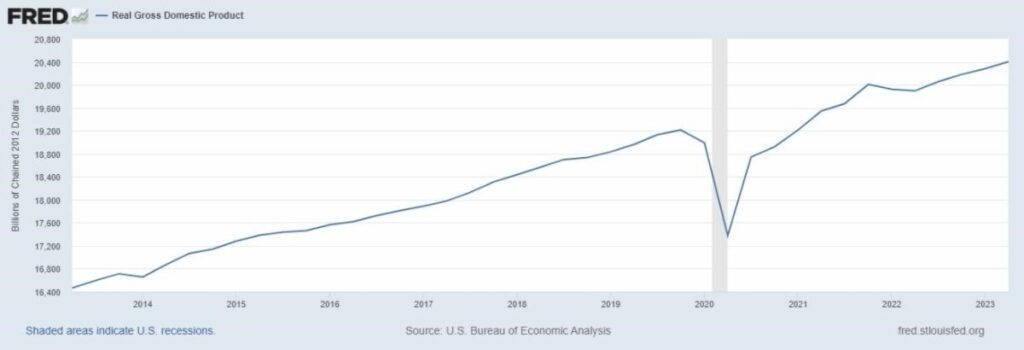

I want to show one more graph, GDP growth in the US.

This is maybe the most remarkable thing to me. In the face of high inflation, restrictive rates, and Federal Reserve balance sheet runoff, the US economy has been extremely resilient. The second quarter GDP was just reported growing at 2.4%. This has been boosted by fiscal spending and ongoing deficit spending from the US government. While this environment is not the most bullish setup for risk assets, it is an environment that can support reasonable growth. There are areas that have been and will continue to be more strained, especially industries that are more rate sensitive, but on net the economy is still showing relative strength.

*Written on 27th of July 2023

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.