Macro Minute: Week of August 14, 2023

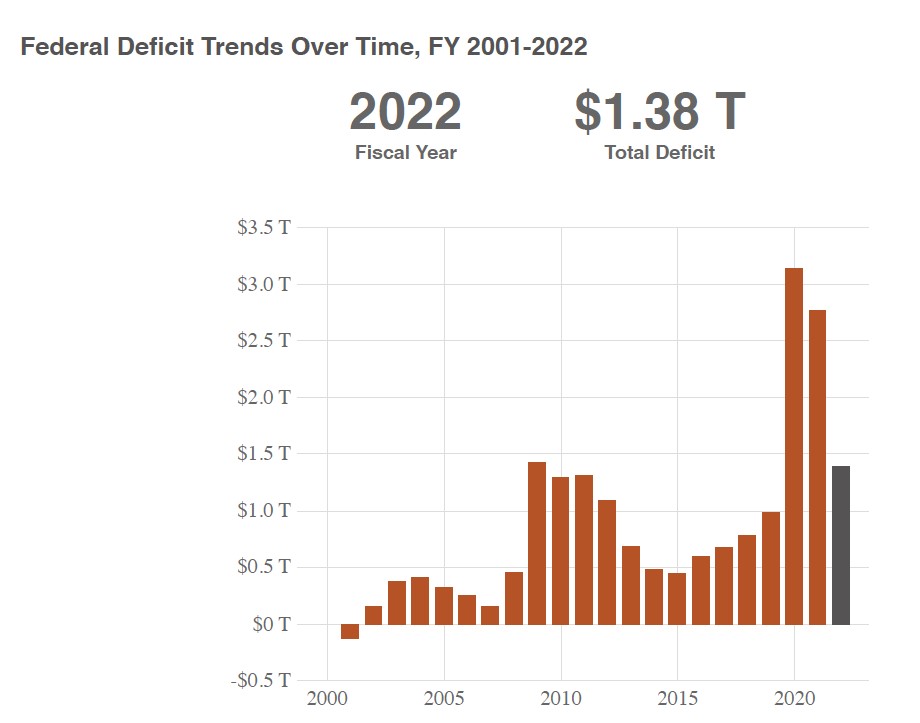

Let’s talk rates for a minute. I am writing this on August 3rd, 2023. Yields on longer dated maturities of treasuries have moved higher this week. I would like to give you my belief as to the main reason. The headline that is grabbing attention is that Fitch downgraded the US from AAA to AA+. While that is grabbing headlines, the real story is at the treasury. But first, let me back up and give some context. In the United States the federal government is spending more money than it receives. This creates a deficit.

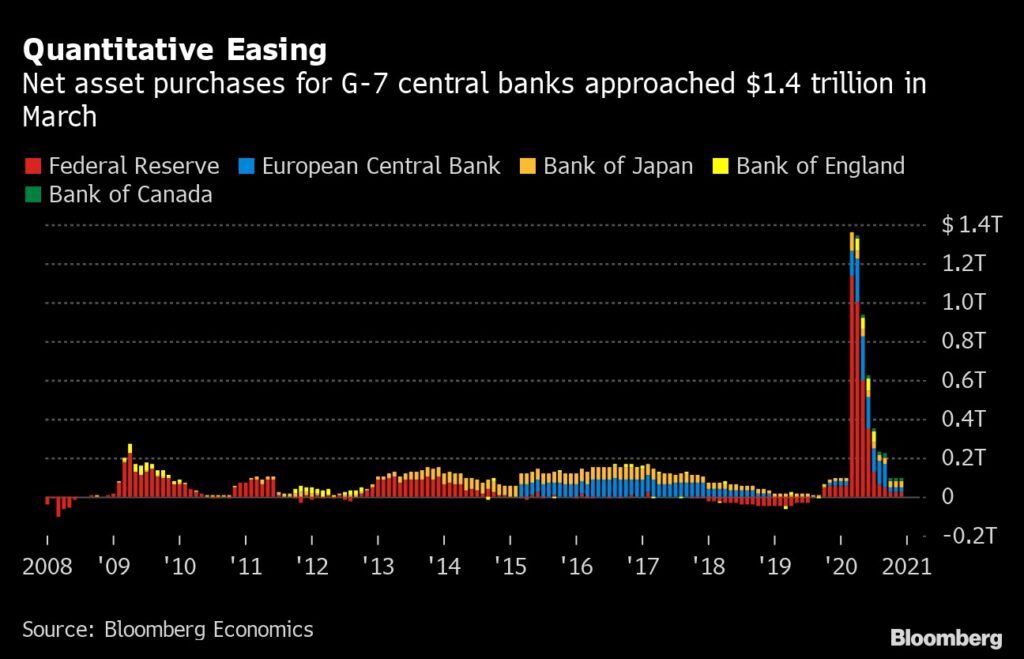

I am not going to comment on the deficit other than to say that there is one and that the government pays for that by the Treasury issuing new bonds or bills. The large spike in 2020 and 2021 was primarily purchased by the Federal Reserve.

This allowed rates to stay lower. However, when the Federal Reserve started Quantitative Tightening (QT) it stopped buying treasuries to hold rates down. They still do buy some treasuries, but they are trying to let their balance sheet shrink slowly over time as bonds mature and not replace them.

Mechanically, the treasury holds auctions on a regular basis and dealers, other governments, funds, and the Federal Reserve purchase them. The Treasury releases a schedule of the planned amount of total issuance for the next couple of quarters. This is called the Quarterly Refunding Announcement (QRA). The QRA was announced on July 31, 2023. The amount that was announced was significantly more than the market was expecting and more than what had been being sold in previous quarters. My opinion is that this is the reason for the recent rise in rates.

In summary, it is my belief that because the Treasury is debt financing budget deficits at a time when the Federal Reserve is no longer a buyer of those bonds, that rates are moving higher. This most recent move higher is because of the announced issuance size surprising the market. When supply is more than the amount demanded at a given price then the price must move to the new price, in this case, lower.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.