Macro Minute: Week of August 7, 2023

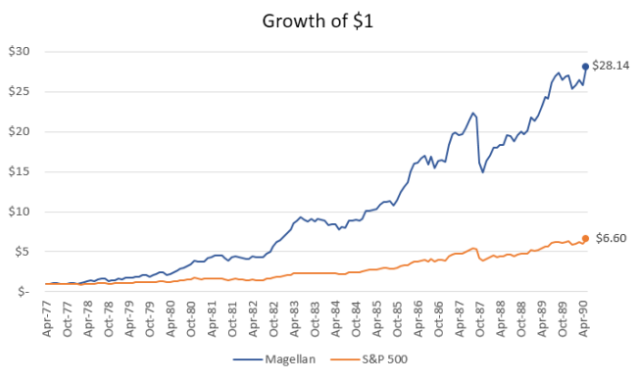

Today I want to do an investor profile. I want to examine Peter Lynch. Peter ran the Fidelity Magellan fund from 1977 to 1990. Over that time, he had annualized returns of 29% doubling up the return of the S&P 500.

What makes this all the more interesting is that Fidelity did a study of the average investor in the fund and discovered that investors only made 7%. The Magellan fund investors would chase the performance then leave as soon as the fund went down. This is why I do not make allocations primarily based on investment returns. It is much more important to evaluate if a manager has changed philosophy or if the manager will do well going forward. In the case of Peter, he never changed his methodology. He would buy companies in sleepy sectors that he believed had outsized growth potentials going forward.

One of his better performing stocks came from his wife. She bought a pair of L’eggs pantyhose from a supermarket. Peter realized that up until then you had to go to department stores to get nice hose and that Hanes was about to do very well by having them in supermarkets and drugstores. His book “One Up on Wall Street” is all about using your practical knowledge of an industry or sector to beat the market. He would regularly say “invest in what you know” and “Go for a business that any idiot can run, because sooner or later, any idiot probably is going to run it.”

Another thing that I loved about Peter was his view of the economy. “I’ve always said if you spend 13 minutes a year on economics, you’ve wasted 10 minutes.” He was a big believer that you cannot know when the next recession would hit, or what interest rates would do, or what the next move in the stock market would be. He would tell his investors that if we have a recession you can expect his portfolio to be down. To sum this up he said, “If you are in the market, you have to know there’s going to be declines.”

Because of his views on economic uncertainty, it led investors to try and come into and out of his fund based on market timing. Peter would say, “The only problem with market timing is getting the timing right.” Probably my favorite quote of Peter is, “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

To sum up this look at Peter Lynch:

- Buy what you know

- Markets have cycles

- Timing those cycles are impossible

- Lots of money is lost trying to time them

- Stay the course

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.