Macro Minute: Week of July 31, 2023

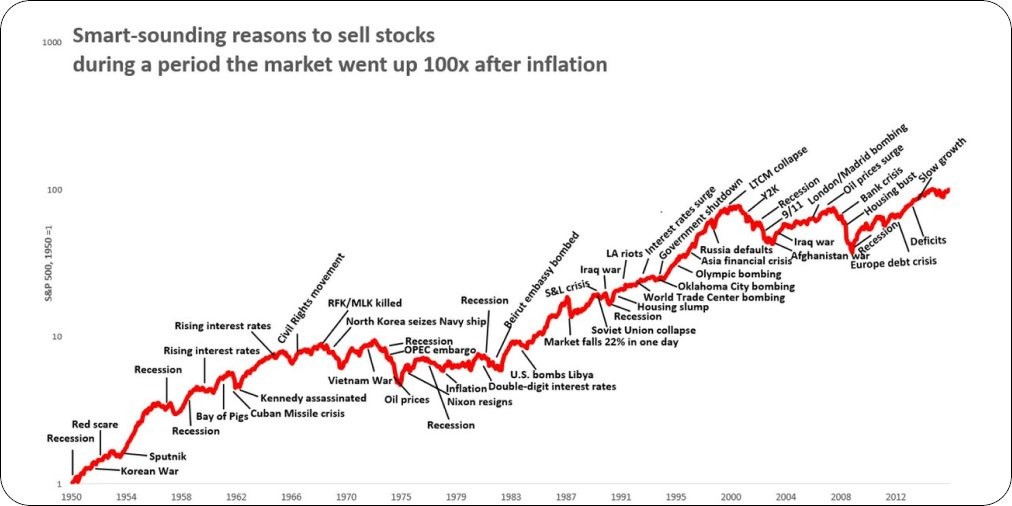

I recently stumbled upon some great charts from @MnkeDaniel on Twitter. I have said, and heard it said, for years that every time in history is full of reasons not to invest. We look back and think, “Man, it would have been easy to make a ton of money back then!” because we know now that it all worked out.

In that moment, it was as terrifying as deciding to invest right now. This is called “hindsight bias”, and it can lead us into thinking the future will not be as bright as the past.

Since 1950, the S&P 500 has gone up 100x after inflation. That time period included eight recessions, multiple military actions, and great changes in interest rates. There is always some reason to sell or not invest, but history shows that’s not the way to make the highest returns.

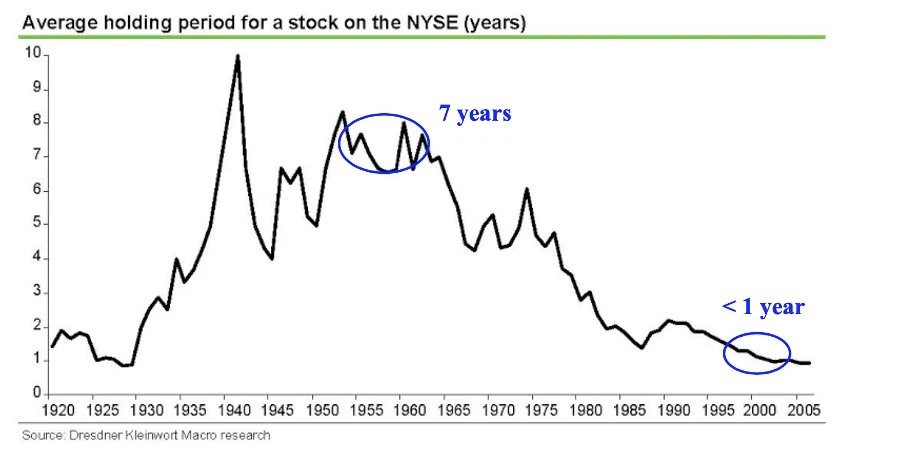

We can see that as time has gone on, we have held positions for shorter and shorter time periods.

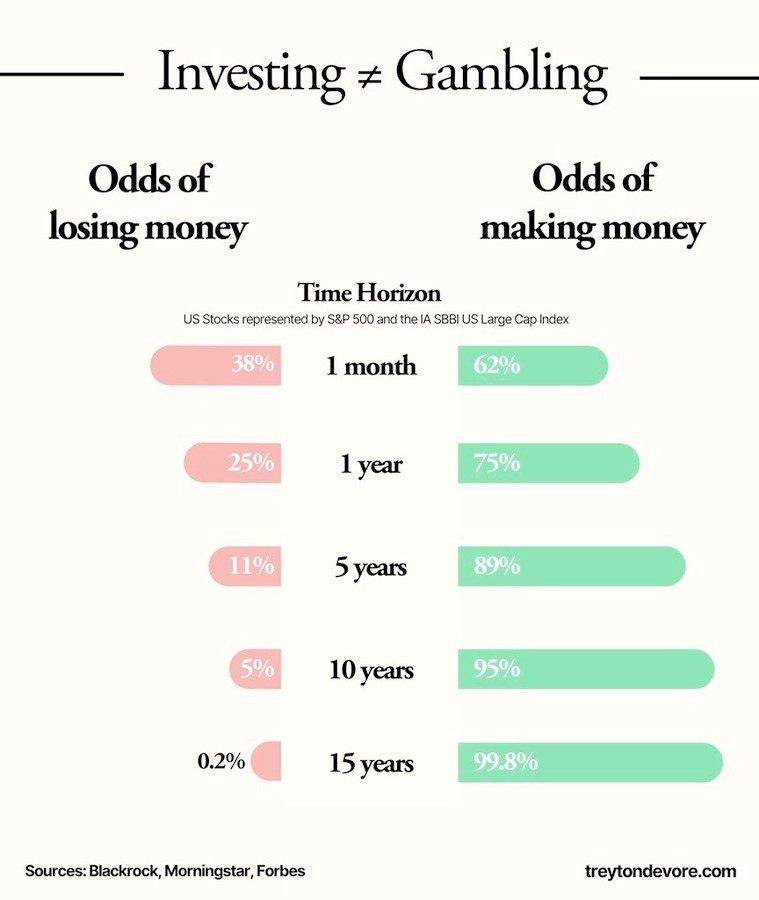

We also know that the longer we hold a position, the more likely there will be positive returns.

We hold investments for longer time periods because we know these things to be true. If you have feelings that make you want to sell a particular holding, ask yourself, “Is there something that has happened in that holding that would justify selling or am I just nervous because of something I heard?”

While it can be challenging to hold onto investments during uncertain times, historical evidence demonstrates the rewards of doing so.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.