Macro Minute: Week of July 10, 2023

Today’s topic that I want to cover is around market and economic trends.

While I will have more charts and observations covering economic trends week to week on the Macro Minute, I want to give a broad overview of how I think about this.

First off, I have to say that you should have a personal financial plan. A plan that lets you not be swayed by the shifting trends. This is what we do here at Longview. We have seen it really does give you that base to build on and helps you make financial decisions that are in your best interest. The key is to develop something that you can stick with.

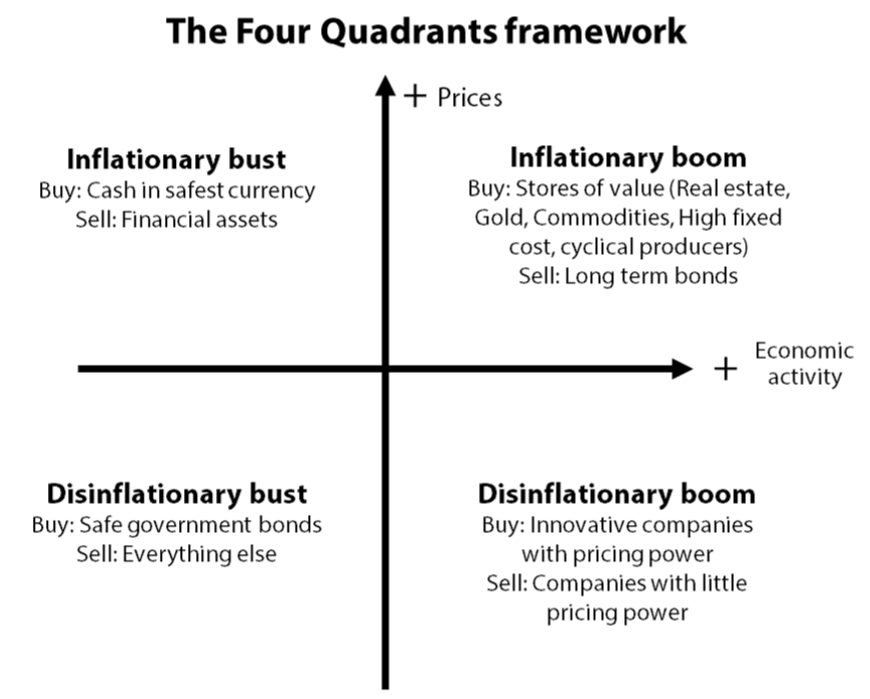

I think the two biggest factors that can have unanticipated changes to markets are economic growth and inflation. These two factors, both positive changes and negative changes, can create detrimental moves within markets. This chart is an example of how to use this change in inflation and economic growth:

For example, a negative growth and negative inflation shock will tend to be bad for stocks and good for bonds. The scenario that causes the most difficulty for stocks and bonds are when you get a big inflation surprise (like the 1970’s and 2022). Because of this, we incorporate managed futures trend and real assets (that have commodity-like tendencies) along with stocks and bonds to help combat these surprises.

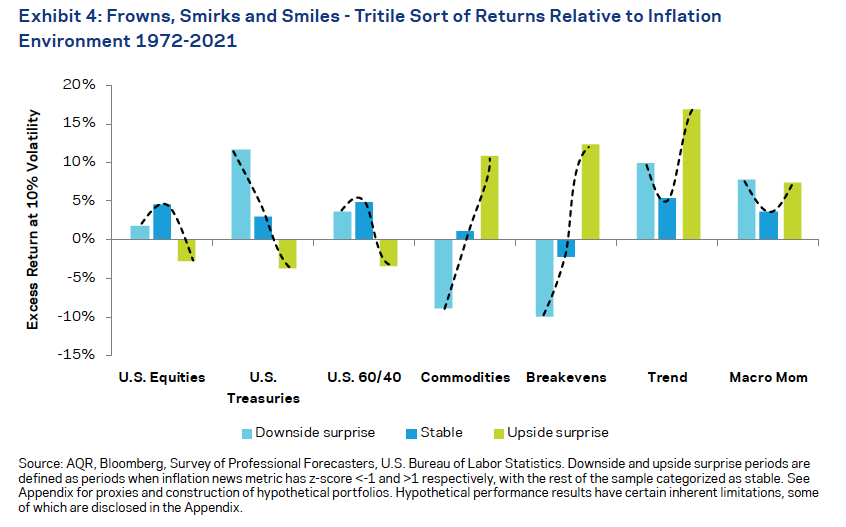

This next chart from the AQR paper When Stock-Bond Diversification Fails shows the benefit these assets can play in a portfolio. Trend and commodities react positively to upside inflation surprises. Remarkably, trend react positively in downside surprises, too.

This week I have gone a little longer than usual, but I felt it necessary to give a baseline from which I start on my economic trends thinking and how it will affect markets. When I talk about economic trends in the future just know that I always start from here and consider how it changes economic growth and inflation.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.