Macro Minute: Week of July 3, 2023

This week I would like to start discussing behavioral tendencies that prevent investors from achieving their goals. Investors often times act irrational and react to emotions over logic. Emotional behavior can negatively impact the long-term success of an investor.

Let’s start with overconfidence.

Overconfidence is when someone is more confident in one’s ability or judgement than the average person. James Montier asked professional fund managers if they were above average in their ability. 74% believed that they were while 26% thought they were average. Nobody thought they were below average. This overconfidence in our ability can lead us to believe strongly in our predictions of the future. I have heard Stanley Druckenmiller (one of the greatest investors ever, he averaged 30% annual returns for 30 years with no down years) say that he is only right on 60% of his trades.

That means one of the best to ever invest was wrong 40% of the time. What does overconfidence lead us to do as investors? It leads us to believe we are better at picking investments than we are. It makes us think we have more control of the outcomes than we do. It also makes us think that we can time the market by getting in and out based on our beliefs of the future, especially if that future outcome is most desirable to us.

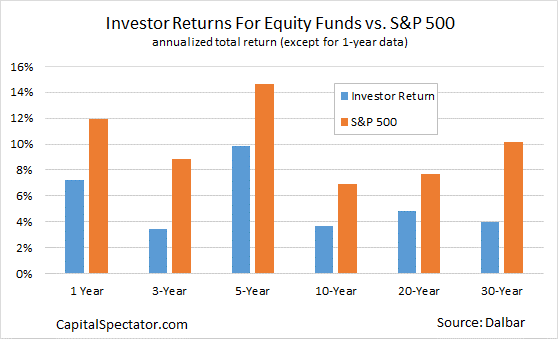

Dalbar does an annual survey that measures investor returns versus index returns. This is a chart from 2016. This chart serves as a visual reminder that investor behavior prevents the achievement of desired returns. As you can see, behavioral tendencies have led to suboptimal outcomes. Here are some of the things that can be done to help overcome our natural tendencies:

- Seek out professional help with your investments. Most professionals by now, have had education that helps them combat these behavioral tendencies and can help you overcome them, too.

- If you have set your allocations based on your long-term goals, don’t trade because of short-term concerns. Said another way, look out over a ten-year period and ask yourself if you think your investments are still right for that time period.

- Do nothing. Sometimes the best thing to do is nothing at all; by definition that is what the indices are: the do nothing return stream.

I hope you enjoyed this look at behavioral finance. I will look to write about these from time to time. They can help us combat our own worst enemy: ourselves.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.