Macro Minute: Week of March 24, 2025

I feel like I need to tackle a misconception that I am seeing everywhere. That is that tariffs are inflationary. On the surface that sounds correct, but let’s think through how this affects prices. I am going to fall back on my economic education here for a minute so bear with me as I draw some supply and demand curves.

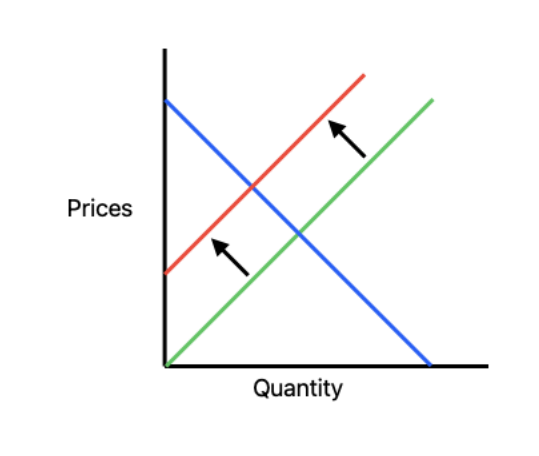

In the above graphic I created, the green line is the amount of goods a producer is willing and able to make at a given price. The blue line is the amount demanded at a given price. Notice as the price goes down the amount demanded goes up. As the price increases the amount demanded goes down. The intersection of the blue and green lines is the market; the amount a producer is willing to make and a buyer is willing to pay.

When a tariff is introduced, it artificially raises the producers’ cost curve. That is the red line; it is where a producer can make the good profitably. Notice what happens. The quantity demanded goes down at that new higher price. Some people that were willing to buy before are now unable to at the new higher price. This will cause a slowing of economic activity. It will end up being deflationary, not inflationary. Because we are a market-based economy, as less quantity is demanded, less money will be multiplied. Said another way, fewer dollars will be exchanged causing less dollars to be traded for that good. Because less goods are being demanded, less employees are needed to produce at that new lower quantity. It trickles down the line that other goods and services will be demanded less because less people are employed. Continuing this thought, it will lead to a slowing of the economic engine that is the consumer.

I have no idea how all of this will play out. I acknowledge that other things are being promoted and stimulated at the same time tariffs are being implemented. If financing rates come down, then that alone can outweigh the impact of tariffs. I just wanted to visually show how a tariff alone is not in fact inflationary, but instead deflationary, through a slowing of economic trade.

DISCLOSURES:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Longview Financial Advisors, Inc.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Longview Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Longview Financial Advisors, Inc. is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Longview Financial Advisors, Inc.’s current written disclosure statement discussing our advisory services and fees is available upon request.